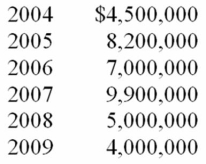

Grumond was incorporated on January 1, 2004, and adopted a calendar year for tax purposes. It had the following gross receipts for its first six taxable years:  For which of these years is Grumond exempt from AMT?

For which of these years is Grumond exempt from AMT?

A) 2004

B) 2004, 2005, and 2006

C) 2004, 2005, 2006, and 2007

D) 2004, 2005, 2006, 2007, and 2009

Correct Answer:

Verified

Q73: Airfreight Corporation has book income of $370,000.Book

Q79: Sunny Vale Co. reported the following for

Q81: Gosling, Inc., a calendar year, accrual basis

Q82: For its current tax year, Volcano, Inc.

Q82: In determining the incidence of the corporate

Q83: This year, Sonoma Corporation received the following

Q85: Corporation F owns 95 percent of the

Q89: Torquay Inc.'s 2011 taxable income was $9,782,200,

Q90: Which of the following statements regarding corporate

Q94: Which of the following is a means

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents