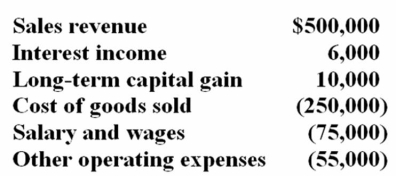

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?

Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?

A) $63,000

B) $60,000

C) $68.000

D) $97,500

Correct Answer:

Verified

Q27: If a business is formed as an

Q30: A limited liability company with more than

Q32: Corporations cannot be shareholders in an S

Q36: Aaron James has a qualifying home office.

Q38: Kelly received a $60,000 salary during 2012.

Q44: Alice is a partner in Axel Partnership.

Q56: Alan is a general partner in ADK

Q63: Cramer Corporation and Mr. Chips formed a

Q64: Bernard and Leon formed a partnership on

Q74: Jackie contributed $60,000 in cash to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents