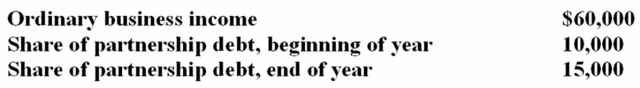

Gavin owns a 50% interest in London Partnership. His tax basis in his partnership interest at the beginning of the year was $20,000. His partnership Schedule K-1 showed the following:  Calculate Gavin's tax basis in his partnership interest at the end of the year?

Calculate Gavin's tax basis in his partnership interest at the end of the year?

A) $85,000

B) $95,000

C) $75,000

D) $65,000

Correct Answer:

Verified

Q65: Cactus Company is a calendar year S

Q66: Mutt and Jeff are general partners in

Q68: Which of the following statements regarding the

Q82: On January 1, Leon purchased a 10%

Q83: In applying the basis limitation on the

Q87: Loretta is the sole shareholder of Country

Q91: Loretta is the sole shareholder of Country

Q96: XYZ, Inc. wishes to make an election

Q97: Which of the following statements regarding S

Q98: Which of the following statements regarding limited

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents