Refer to the facts in the preceding problem. Ted is a 20 percent general partner in Bevo.

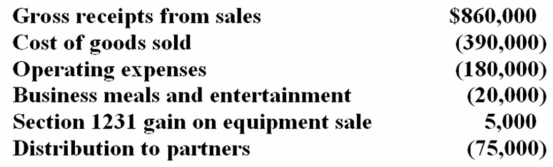

Bevo Partnership had the following financial activity for the year:  a. Compute Ted's share of partnership ordinary income and separately stated items.

a. Compute Ted's share of partnership ordinary income and separately stated items.

b. If Ted's adjusted basis in his Bevo interest was $30,000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that Bevo's debt did not change during the year.

c. How would your basis computation change if Bevo's debt at the end of the year as $50,000 less than its debt at the beginning of the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: At the beginning of year 1, Paulina

Q71: Which of the following statements regarding limited

Q76: Orange, Inc. is a calendar year partnership

Q79: Alex is a partner in a calendar

Q80: Funky Chicken is a calendar year general

Q82: Bevo Partnership had the following financial activity

Q83: On January 1, 2012, Laura Wang contributed

Q84: At the beginning of 2012, Quentin purchased

Q85: On January 1, 2012, Conrad Nelson contributed

Q86: In 2012, William Wallace's sole proprietorship, Western

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents