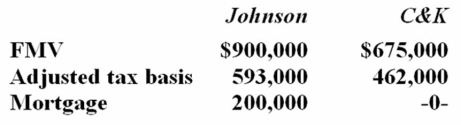

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

A) $25,000 gain recognized; $593,000 basis in C&K property

B) $25,000 gain recognized; $793,000 basis in C&K property

C) $225,000 gain recognized; $593,000 basis in C&K property

D) None of the above

Correct Answer:

Verified

Q46: Itak Company transferred an old asset with

Q59: Oxono Company realized a $74,900 gain on

Q61: Babex Inc. and OMG Company entered into

Q66: Johnson Inc. and C&K Company entered into

Q67: Perry Inc. and Dally Company entered into

Q68: Babex Inc. and OMG Company entered into

Q69: In April,vandals completely destroyed outdoor signage owned

Q71: Thieves stole computer equipment used by Ms.James

Q78: Mr.and Mrs.Eyre own residential rental property that

Q82: Vincent Company transferred business realty (FMV $2.3

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents