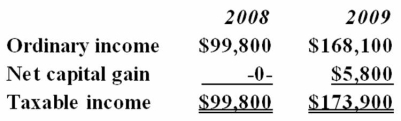

Fantino Inc. was incorporated in 2008 and adopted a calendar year for tax purposes. Here is a schedule of Fantino's taxable income for 2008 and 2009.  In 2010, Fantino generated $297,300 ordinary income and recognized a $14,000 net capital loss. Which of the following statements is true?

In 2010, Fantino generated $297,300 ordinary income and recognized a $14,000 net capital loss. Which of the following statements is true?

A) Fantino can deduct its $14,000 net capital loss only on a carryforward basis.

B) Fantino can carry the net capital loss back to 2008 and receive a $4,760 refund of 2008 tax.

C) Fantino can carry the net capital loss back to 2009 and receive a $5,460 refund of 2009 tax.

D) Fantino can carry the net capital loss back to 2009 and receive a $2,262 refund of 2009 tax.

Correct Answer:

Verified

Q63: In its current tax year, PRS Corporation

Q69: Hugo Inc.,a calendar year taxpayer,sold two operating

Q72: Rizzi Corporation sold a capital asset with

Q76: Which of the following is a capital

Q77: Gupta Company made the following sales of

Q79: Norbett Inc. generated $15,230,000 ordinary taxable income

Q80: This year, Adula Company sold equipment purchased

Q83: Mr. and Mrs. Marley operate a small

Q90: Zeron Inc. generated $1,349,600 ordinary income from

Q95: Lettuca Inc. generated a $77,050 ordinary loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents