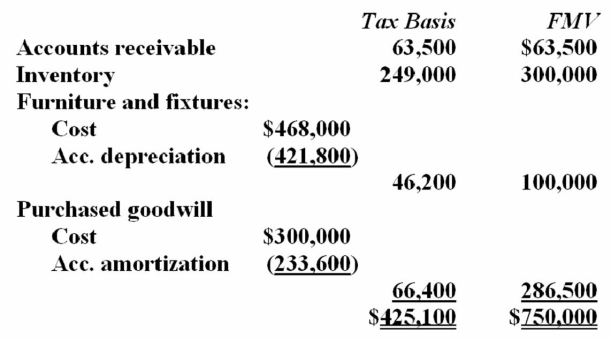

Twelve years ago, Mr. and Mrs. Bathgate purchased a business. This year, they sold the business for $750,000 lump-sum payment. The business had the following balance sheet assets.  As a result of the sale, the Bathgates should recognize:

As a result of the sale, the Bathgates should recognize:

A) $324,900 ordinary gain

B) $104,800 ordinary gain and $220,100 capital gain

C) $51,000 ordinary gain and $273,900 Section 1231 gain

D) None of the above

Correct Answer:

Verified

Q83: Mr. and Mrs. Marley operate a small

Q86: Firm F purchased a commercial office building

Q87: Bastrop Inc. generated a $169,000 ordinary loss

Q91: Several years ago, Nipher paid $70,000 to

Q93: B&I Inc. sold a commercial office building

Q95: Delta Inc. generated $668,200 ordinary income from

Q106: Steiger Company owned investment land subject to

Q110: Princetown Inc. has a $4.82 million basis

Q110: Ficia Inc.owned investment land subject to a

Q113: Two months ago, Dawes Inc. broke a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents