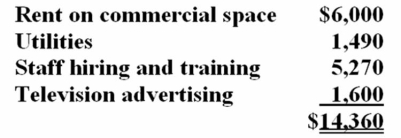

Puloso Company, a calendar year taxpayer, incurred the following start-up expenditures before the opening of its new health and fitness center.  The Puloso Center opened its doors for business on March 21, 2011. How much of the start-up expenditures can Puloso deduct in 2011?

The Puloso Center opened its doors for business on March 21, 2011. How much of the start-up expenditures can Puloso deduct in 2011?

A) -0-

B) $5,000

C) $5,520

D) $14,360

Correct Answer:

Verified

Q64: Durna Inc., a calendar year taxpayer, made

Q80: In 2011, Rydin Company purchased one asset

Q81: Ferelli Inc. is a calendar year taxpayer.

Q82: Which of the following statements about the

Q86: Mann Inc. paid $7,250 to a leasing

Q93: Powell Inc.was incorporated and began operations on

Q93: Mann Inc. negotiated a 36-month lease on

Q96: Which of the following statements concerning business

Q98: Mr.and Mrs.Carleton founded Carleton Industries in 1993.This

Q115: Driller Inc. has $498,200 of unrecovered capitalized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents