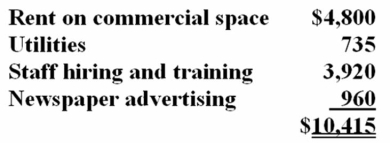

Vane Company, a calendar year taxpayer, incurred the following expenditures in the preoperating phase of a new health and fitness center.  Which of the following statements is true?

Which of the following statements is true?

A) If Vane already operates seven other health and fitness centers, it can deduct the $10,415 preoperating expenditures of the eighth center as expansion costs.

B) If Vane is a cash basis taxpayer, it can deduct $10,415 in the year of payment.

C) If the new center represents a new business for Vane, it must capitalize the $10,415 preoperating expenditures.

D) None of the above is true.

Correct Answer:

Verified

Q89: Mann Inc., a calendar year taxpayer, incurred

Q90: Four years ago, Bettis Inc. paid a

Q94: Merkon Inc. must choose between purchasing a

Q94: Ingol,Inc.was organized on June 1 and began

Q95: JebSim Inc. was organized on June 1,

Q97: On April 2, Reid Inc., a calendar

Q100: Four years ago,Bettis Inc.paid a $5 million

Q101: NRW Company, a calendar year taxpayer, purchased

Q102: On May 1, Sessi Inc., a calendar

Q106: Follen Company is a calendar year taxpayer.On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents