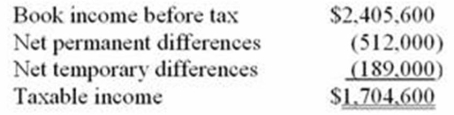

Southlawn Inc.'s taxable income is computed as follows.  Using a 34% rate, compute Southlawn's tax expense per books and tax payable.

Using a 34% rate, compute Southlawn's tax expense per books and tax payable.

A) Tax expense per books $643,824; tax payable $579,564

B) Tax expense per books $579,564; tax payable $643,824

C) Tax expense per books $817,904; tax payable $579,564

D) None of the above

Correct Answer:

Verified

Q61: Which of the following statements regarding book/tax

Q61: Tax expense per books is based on:

A)

Q66: Which of the following statements concerning the

Q68: According to your textbook, business managers prefer

Q69: Which of the following does not result

Q78: Eaton Inc. is a calendar year, cash

Q80: B&B Inc.'s taxable income is computed as

Q83: BugLess Inc, a calendar year, accrual basis

Q87: Which of the following statements about the

Q99: Eddy Corporation engaged in a transaction that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents