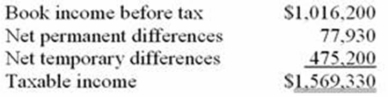

Goff Inc.'s taxable income is computed as follows.  Using a 34% rate, compute Goff's tax expense per books and tax payable.

Using a 34% rate, compute Goff's tax expense per books and tax payable.

A) Tax expense per books $345,508; tax payable $372,004

B) Tax expense per books $345,508; tax payable $533,572

C) Tax expense per books $507,076; tax payable $372,004

D) Tax expense per books $372,004; tax payable $533,572

Correct Answer:

Verified

Q44: Welch Inc.has used a fiscal ending September

Q49: Stack Inc. owns a $1 million insurance

Q54: Which of the following statements about the

Q57: Pim Inc. operates a business with a

Q63: B&B Inc.'s taxable income is computed as

Q64: Which of the following statements concerning the

Q64: Which of the following statements describes a

Q65: Southlawn Inc.'s taxable income is computed as

Q71: Which of the following statements about the

Q77: Which of the following does not result

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents