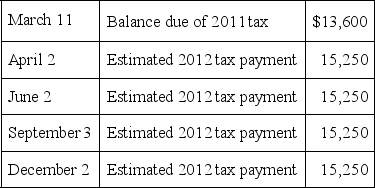

Marchal Inc., a calendar year, accrual basis taxpayer, made the following state income tax payments during 2012.

On December 28, Marchal's tax department calculated that the corporation's actual 2012 state income tax liability was $67,140. Consequently, Marchal accrued a $6,140 liability for state income tax payable at year end.

On December 28, Marchal's tax department calculated that the corporation's actual 2012 state income tax liability was $67,140. Consequently, Marchal accrued a $6,140 liability for state income tax payable at year end.

a. Compute Marchal's 2012 state income tax expense per books.

b. If Marchal has not adopted the recurring item exception as its method of accounting for state income taxes, compute Marchal's 2012 federal deduction for state income tax.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Hitz Company, a calendar year, accrual basis

Q91: Unex Company is an accrual basis taxpayer.

Q98: Mr. John Carre owns 67% of the

Q99: Mundo Company is a calendar year, accrual

Q104: Randall Company uses the calendar year and

Q105: Krasco Inc.'s auditors prepared the following reconciliation

Q106: Which of the following statements about an

Q107: Monro Inc. uses the accrual method of

Q113: Assuming a 30% marginal tax rate,compute the

Q114: Slumar,an accrual basis,calendar year corporation,reported $7,289,200 net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents