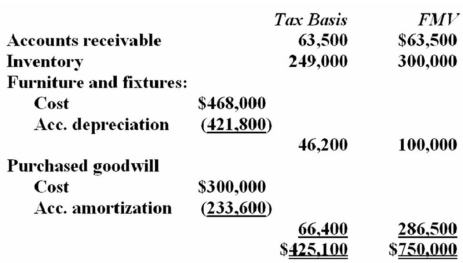

Twelve years ago, Mr. and Mrs. Bathgate purchased a business. This year, they sold the business for $750,000 lump-sum payment. The business had the following balance sheet assets.  As a result of the sale, the Bathgates should recognize:

As a result of the sale, the Bathgates should recognize:

A) $324,900 ordinary gain

B) $104,800 ordinary gain and $220,100 capital gain

C) $51,000 ordinary gain and $273,900 Section 1231 gain

D) None of the above

Correct Answer:

Verified

Q96: B&I Inc. sold a commercial office building

Q102: Oslego Company, a calendar year taxpayer, sold

Q105: Mrs. Stile owns investment land subject to

Q106: Steiger Company owned investment land subject to

Q109: A tornado demolished several delivery vans owned

Q110: Ficia Inc.owned investment land subject to a

Q112: DiLamer Inc. paid $300,000 to purchase 30-year

Q114: Thieves stole computer equipment owned by Eaton

Q119: A fire completely destroyed a warehouse owned

Q121: McOwen Inc.reported $6,029,400 net income before tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents