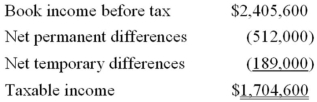

Southlawn Inc.'s taxable income is computed as follows.  Southlawn's tax rate is 34%. Which of the following statements is true?

Southlawn's tax rate is 34%. Which of the following statements is true?

A) The permanent differences caused a $174,080 net increase in Southlawn's deferred tax liabilities.

B) The permanent differences caused a $174,080 net decrease in Southlawn's deferred tax liabilities.

C) The temporary differences caused a $64,260 net increase in Southlawn's deferred tax liabilities.

D) The temporary differences caused a $64,260 net decrease in Southlawn's deferred tax liabilities.

Correct Answer:

Verified

Q61: Which of the following statements regarding book/tax

Q64: Which of the following statements describes a

Q66: Addis Company operates a retail men's clothing

Q66: Which of the following statements concerning the

Q68: According to your textbook, business managers prefer

Q70: Which of the following businesses can't use

Q72: B&B Inc.'s taxable income is computed as

Q72: Which of the following statements about the

Q73: Goff Inc.'s taxable income is computed as

Q80: Southlawn Inc.'s taxable income is computed as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents