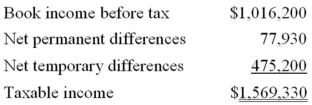

Goff Inc.'s taxable income is computed as follows.  Using a 34% rate, compute Goff's tax expense per books and tax payable.

Using a 34% rate, compute Goff's tax expense per books and tax payable.

A) Tax expense per books $345,508; tax payable $372,004

B) Tax expense per books $345,508; tax payable $533,572

C) Tax expense per books $507,076; tax payable $372,004

D) Tax expense per books $372,004; tax payable $533,572

Correct Answer:

Verified

Q61: Which of the following statements regarding book/tax

Q64: Which of the following statements describes a

Q66: Addis Company operates a retail men's clothing

Q66: Which of the following statements concerning the

Q68: On December 12, 2013, Hook Company, a

Q69: Which of the following does not result

Q70: Which of the following businesses can't use

Q72: B&B Inc.'s taxable income is computed as

Q72: Which of the following statements about the

Q75: Southlawn Inc.'s taxable income is computed as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents