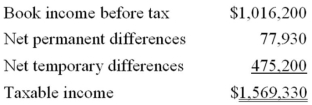

Goff Inc.'s taxable income is computed as follows.  Goff's tax rate is 34%. Which of the following statements is true?

Goff's tax rate is 34%. Which of the following statements is true?

A) The permanent differences caused a $26,496 net increase in Goff's deferred tax liabilities.

B) The permanent differences caused a $26,496 net increase in Goff's deferred tax assets.

C) The temporary differences caused a $161,568 net increase in Goff's deferred tax assets.

D) The temporary differences caused a $161,568 net increase in Goff's deferred tax liabilities.

Correct Answer:

Verified

Q49: For its first taxable year,UY Products Inc.generated

Q50: Which of the following statements about short-period

Q57: Pim Inc. operates a business with a

Q61: Which of the following businesses is prohibited

Q62: B&B Inc.'s taxable income is computed as

Q64: Which of the following statements concerning the

Q65: Eaton Inc. is a calendar year, cash

Q68: On December 12, 2013, Hook Company, a

Q71: Which of the following statements about the

Q77: Which of the following does not result

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents