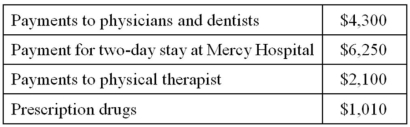

Dotty, age 45, incurred the following medical expenses this year.  Dotty's insurance company reimbursed her for $8,800 of these expenses. If Dotty's AGI is $35,400, compute her medical expense deduction.

Dotty's insurance company reimbursed her for $8,800 of these expenses. If Dotty's AGI is $35,400, compute her medical expense deduction.

A) $0

B) $1,320

C) $10,120

D) $13,660

Correct Answer:

Verified

Q45: Mr. and Mrs. Shohler received $25,200 Social

Q45: Josh donated a painting to the local

Q50: Which of the following tax payments is

Q55: Mr. and Mrs. McGraw received $50,160 Social

Q59: Mr. and Mrs. Trent divorced last year.

Q61: Which of the following is not a

Q64: Mr.and Mrs.Blake suffered two casualty losses this

Q67: Mr. Rex had his car stolen this

Q70: Gary is a successful architect who also

Q72: Ms.Ruang owns a principal residence subject to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents