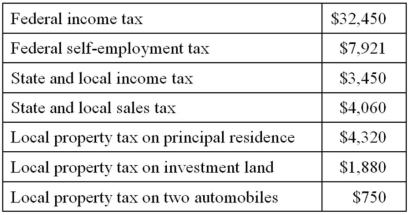

Mr. Jain paid the following taxes this year.  Compute Mr. Jain's itemized deduction for taxes.

Compute Mr. Jain's itemized deduction for taxes.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Which of the following donations does not

Q66: Which of the following statements about tax

Q67: Mr.and Mrs.Perry own three personal residences,all of

Q68: Mr. and Mrs. Frazier recognized a $723,000

Q78: Mr.and Mrs.King had only one casualty loss

Q83: On February 1, 2013, Alan, a single

Q84: Mr.and Mrs.Allen made the following interest payments.Determine

Q85: On February 1, 2013, Alan, a single

Q85: Mrs.Hanson's financial support this year consisted of:

Q86: Which of the following deductions is disallowed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents