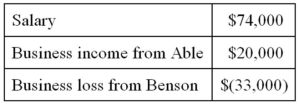

Mr. Vernon owns stock in two S corporations, Able Corporation and Benson Inc. This year, Mr. Vernon had the following income and loss items.  If Vernon materially participates in Able's business but not in Benson's business, compute his AGI.

If Vernon materially participates in Able's business but not in Benson's business, compute his AGI.

A) $94,000

B) $74,000

C) $61,000

D) $41,000

Correct Answer:

Verified

Q46: Six years ago, Mr. Ahmed loaned $10,000

Q77: In 2011, Mrs. Owens paid $50,000 for

Q78: In 2011, Mrs. Owens paid $50,000 for

Q79: Mr. and Mrs. Philips recognized the following

Q81: Last year, Mr. Margot purchased a limited

Q83: Mrs. Heyer inherited real estate from her

Q88: Which of the following statements about the

Q91: This year,Mr.and Mrs.Lebold paid $3,100 investment interest

Q92: Ms.Poppe,a single taxpayer,made three gifts this year:

Q92: Which of the following are included in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents