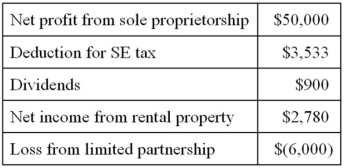

Mr. and Mrs. Nelson operate a small business as a sole proprietorship. This year, they have the following tax information.  Compute Mr. and Mrs. Nelson's AGI.

Compute Mr. and Mrs. Nelson's AGI.

A) $50,900

B) $47,367

C) $50,147

D) None of the above

Correct Answer:

Verified

Q73: Which of the following statements about an

Q92: Bess gave her grandson ten acres of

Q93: Ms. Watts owns stock in two S

Q93: Ms.Regga,a physician,earned $375,000 from her medical practice

Q94: Ms.Plant owns and actively manages an apartment

Q98: Ms. Cowler owns stock in Serzo Inc.,

Q99: Mr. Lee made the following transfers this

Q100: Mr.and Mrs.Gupta want to make cash gifts

Q101: Mr. Ames, an unmarried individual, made a

Q102: Mr. Carp, a single taxpayer, recognized a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents