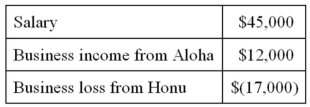

Ms. Mollani owns stock in two S corporations, Aloha and Honu. This year, she had the following income and loss items:  Compute Ms. Mollani's AGI under each of the following assumptions.

Compute Ms. Mollani's AGI under each of the following assumptions.

a. She materially participates in Aloha's business but not in Honu's business.

b. She materially participates in Honu's business but not in Aloha's business.

c. She materially participates in both corporate businesses.

d. She does not materially participate in either business.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Mr. Lainson died this year on a

Q85: Ms. Adair, a single individual, has $218,000

Q89: Mr.and Mrs.Bolt's joint return reports $267,500 AGI,which

Q93: Ms.Regga,a physician,earned $375,000 from her medical practice

Q94: Ms.Plant owns and actively manages an apartment

Q101: Mr. Ames, an unmarried individual, made a

Q102: Mr. Carp, a single taxpayer, recognized a

Q108: Beverly earned a $75,000 salary and recognized

Q108: Mr McCann died this year. During his

Q108: In 2011, Mr. Yang paid $160,000 for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents