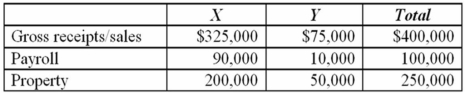

Cambridge, Inc. conducts business in states X and Y. This year, its before-tax income was $150,000. Below is information regarding its sales, payroll, and property factors in both states.  Both states apply an equally-weighted three-factor formula to apportion income. State X has a 10% corporate income tax and state Y has a 5% corporate income tax. Compute the state tax savings if Cambridge could relocate $100,000 of property and $50,000 of payroll from state X to state Y.

Both states apply an equally-weighted three-factor formula to apportion income. State X has a 10% corporate income tax and state Y has a 5% corporate income tax. Compute the state tax savings if Cambridge could relocate $100,000 of property and $50,000 of payroll from state X to state Y.

A) $2,250

B) $12,563

C) $11,532

D) $9,094

Correct Answer:

Verified

Q23: The deemed paid foreign tax credit treats

Q23: The income earned by a foreign branch

Q30: Under most tax treaties, income attributable to

Q43: Which of the following activities create state

Q47: Which of the following could result in

Q48: Which of the following statements about the

Q51: Harris Corporation's before-tax income was $400,000.It does

Q54: A foreign source dividend received by a

Q58: A U.S.parent corporation that receives a dividend

Q60: Section 482 of the Internal Revenue Code

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents