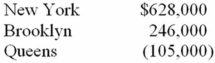

New York, Inc. owns 100% of Brooklyn, Inc. and Queens, Inc. Taxable income for the three corporations for their first year was as follows:  Which of the following statements is false?

Which of the following statements is false?

A) Consolidated taxable income is $769,000.

B) If a consolidated return is filed, Queens, Inc.will receive immediate tax benefit from its operating loss.

C) If Brooklyn, Inc.is a foreign corporation, it can be part of a consolidated return.

D) The corporations are not required to file a consolidated tax return if they are an affiliated group; however, they may elect to do so.

Correct Answer:

Verified

Q43: Sonic Corporation has a 35% marginal tax

Q45: Corporations are rarely targeted in political debates

Q47: Westside,Inc.owns 15% of Innsbrook's common stock.This year,Westside

Q48: Thunder, Inc. has invested in the stock

Q54: Loda Inc. made an $8,300 nondeductible charitable

Q55: Which of the following is a primary

Q56: The stock of Wheel Corporation, a U.S.

Q58: Aaron, Inc. is a nonprofit corporation that

Q67: Palm Corporation has book income of $424,000.Book

Q78: A corporation that owns more than $10

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents