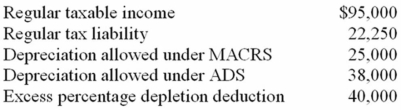

Loraine Manufacturing, Inc. reported the following for the current tax year:  What is Loraine Manufacturing's alternative minimum taxable income before any AMT exemption?

What is Loraine Manufacturing's alternative minimum taxable income before any AMT exemption?

A) $55,000

B) $135,000

C) $122,000

D) $82,000

Correct Answer:

Verified

Q66: TasteCo,Inc.reported $210,500 of taxable income this year.What

Q68: Honu,Inc.has book income of $1,200,000.Book income includes

Q69: Morton Inc. is a Kansas corporation engaged

Q69: Lexington Associates,Inc.is a personal service corporation.This year,Lexington

Q70: Calliwell Corporation is a Colorado corporation engaged

Q70: WEK Inc.is a New York corporation with

Q72: Silver Bullet Inc. reported the following for

Q73: Airfreight Corporation has book income of $370,000.Book

Q74: Which of the following statements regarding the

Q84: Which of the following statements about the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents