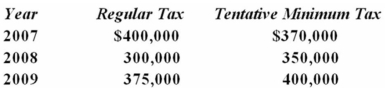

Tropical Corporation was formed in 2007. For 2007 through 2009, its regular and tentative minimum tax were as follows:  a. Compute Tropical's tax due for each year

a. Compute Tropical's tax due for each year

b. In 2010, Tropical's regular taxable income is $2,000,000, and it has positive AMT adjustments of $500,000 and AMT preferences of $600,000. Compute Tropical's regular tax, tentative minimum tax, and tax due for 2010.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Gosling, Inc., a calendar year, accrual basis

Q87: Grumond was incorporated on January 1, 2004,

Q90: Which of the following statements regarding corporate

Q91: Assuming that the corporation has a 34%

Q92: Corporation F owns 95 percent of the

Q93: Harmon, Inc. was incorporated and began business

Q94: Franton Co., a calendar year, accrual basis

Q95: Torquay Inc.'s 2012 taxable income was $9,782,200,

Q98: Which of the following statements regarding the

Q100: Joanna has a 35% marginal tax rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents