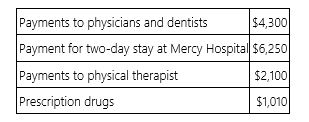

Dotty, age 45, incurred the following medical expenses this year.  Dotty's insurance company reimbursed her for $8,800 of these expenses. If Dotty's AGI is $35,400, compute her medical expense deduction.

Dotty's insurance company reimbursed her for $8,800 of these expenses. If Dotty's AGI is $35,400, compute her medical expense deduction.

A) $0

B) $1,320

C) $10,120

D) $13,660

Correct Answer:

Verified

Q45: Josh donated a painting to the local

Q46: Which of the following statements about divorce

Q47: Which of the following expenditures is not

Q47: Ted and Alice divorced this year. Pursuant

Q50: Which of the following tax payments is

Q51: Three years ago, Suzanne bought a new

Q54: Which of the following items is not

Q55: Which of the following government transfer payments

Q55: Mr. and Mrs. McGraw received $50,160 Social

Q75: A flood destroyed an antique Persian rug

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents