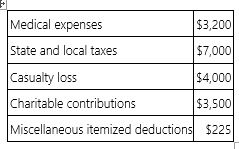

Mr. and Mrs. Hunt, ages 38 and 33, have the following allowable itemized deductions this year.

Determine the effect on the amount of each deduction if the Hunts engage in a transaction generating $10,000 additional AGI this year.

Determine the effect on the amount of each deduction if the Hunts engage in a transaction generating $10,000 additional AGI this year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Mr.and Mrs.Alvarez paid $130,000 for their home

Q83: On February 1, 2015, Alan, a single

Q84: Mr.and Mrs.Allen made the following interest payments.Determine

Q85: Mrs.Hanson's financial support this year consisted of:

Q86: Which of the following deductions is disallowed

Q87: Mr.and Mrs.Stimson incurred $3,937 of miscellaneous itemized

Q87: Mr. and Mrs. Darwin sold their principal

Q88: On February 1, 2015, Alan, a single

Q89: Mr. Jain paid the following taxes this

Q92: Which of the following itemized deductions is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents