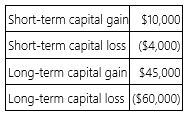

Mr. and Mrs. Philips recognized the following capital gains and losses this year.  Their AGI before consideration of these gains and losses was $140,000. Compute their AGI.

Their AGI before consideration of these gains and losses was $140,000. Compute their AGI.

A) $140,000

B) $131,000

C) $137,000

D) $143,000

Correct Answer:

Verified

Q46: Six years ago, Mr. Ahmed loaned $10,000

Q62: Mr. Forest, a single taxpayer, recognized a

Q68: Ms. Kerry, who itemized deductions on Schedule

Q71: Frederick Tims, a single individual, sold the

Q72: Tom Johnson, whose marginal tax rate on

Q72: Which of the following statements about Section

Q73: Which of the following statements about investment

Q75: Which of the following statements about the

Q77: Mr.Quinn recognized a $900 net short-term capital

Q80: In 1996, Mr. Exton, a single taxpayer,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents