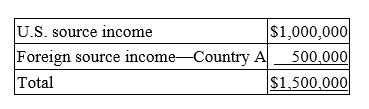

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

A) 34%

B) 35%

C) 44%

D) 45%

Correct Answer:

Verified

Q63: Global Corporation, a U.S. multinational, began operations

Q67: Cambridge, Inc. conducts business in states X

Q68: Which of the following statements concerning the

Q69: Jenkin Corporation reported the following for its

Q70: Albany, Inc. does business in states C

Q71: San Carlos Corporation, a U.S. multinational, had

Q72: Many Mountains, Inc. is a U.S. multinational

Q73: Mega, Inc., a U.S. multinational, has pretax

Q79: Southern,an Alabama corporation,has a $7 million excess

Q80: Which of the following statements about income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents