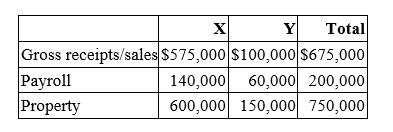

Origami does business in states X and Y. State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate. State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate. Cromwell's taxable income, before apportionment, is $3 million. Its sales, payroll, and property information are as follows.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

b. State Y is considering changing its apportionment formula to a single sales factor. Given its current level of activity, would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Lincoln Corporation,which has a 34% marginal tax

Q91: Which of the following statements about the

Q95: Which of the following statements about subpart

Q96: If a U.S.multinational corporation incurs start-up losses

Q102: Pogo,Inc.,which has a 34 percent marginal tax

Q103: Columbus Inc.owns 100 percent of the stock

Q105: Koscil Inc. had the following taxable income.

Q106: DFJ, a Missouri corporation, owns 55% of

Q106: Sunny, a California corporation, earned the following

Q107: This year, Plateau, Inc.'s before-tax income was

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents