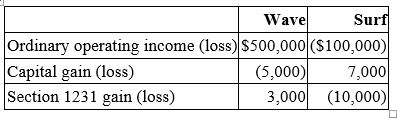

Wave Corporation owns 90% of the stock of Surf, Inc. Each corporation reports the following separate items for the current tax year:  Compute consolidated taxable income if Wave and Surf file a consolidated federal income tax return:

Compute consolidated taxable income if Wave and Surf file a consolidated federal income tax return:

A) $400,000

B) $395,000

C) $410,000

D) $500,000

Correct Answer:

Verified

Q44: In its first taxable year,Platform,Inc.generated a $200,000

Q47: New York, Inc. owns 100% of Brooklyn,

Q47: Westside,Inc.owns 15% of Innsbrook's common stock.This year,Westside

Q50: Thunder, Inc. has invested in the stock

Q51: Brace, Inc. owns 90% of West common

Q53: Corporations report their taxable income and calculate

Q56: The stock of Wheel Corporation, a U.S.

Q56: Fleet,Inc.owns 85% of the stock of Pete,Inc.and

Q58: Aaron, Inc. is a nonprofit corporation that

Q78: A corporation that owns more than $10

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents