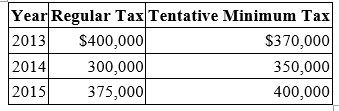

Tropical Corporation was formed in 2013. For 2013 through 2015, its regular and tentative minimum tax were as follows:

a. Compute Tropical's tax due for each year.

a. Compute Tropical's tax due for each year.

b. In 2016, Tropical's regular taxable income is $2,000,000, and it has positive AMT adjustments of $500,000 and AMT preferences of $600,000. Compute Tropical's regular tax, tentative minimum tax, and tax due for 2016.

Correct Answer:

Verified

a. Tax due: 2013, $400,000; 2014, $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Harmon, Inc. was incorporated and began business

Q93: Pocahontas, Inc. had the following results for

Q94: Which of the following is a means

Q94: Silver Bullet Inc. reported the following for

Q95: Aloha, Inc. had the following results for

Q96: Loraine Manufacturing, Inc. reported the following for

Q100: This year, Sonoma Corporation received the following

Q100: Joanna has a 35% marginal tax rate

Q102: Franton Co., a calendar year, accrual basis

Q102: Gosling, Inc., a calendar year, accrual basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents