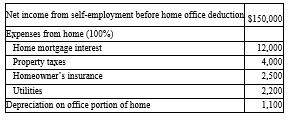

Aaron James has a qualifying home office. The office is 500 square feet and the entire house is 2,500 square feet. Use the following information to determine his allowable home office deduction:

A) $5,240

B) $4,140

C) $4,260

D) $21,800

Correct Answer:

Verified

Q21: Which of the following statements regarding the

Q23: The earnings of a C corporation are

Q24: John's share of partnership loss was $60,000.

Q25: If a partner's share of partnership losses

Q26: A major advantage of an S corporation

Q27: If a business is formed as an

Q30: Tax savings achieved by operating a business

Q30: A partner's tax basis in his or

Q32: Corporations cannot be shareholders in an S

Q34: Randolph Scott operates a business as a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents