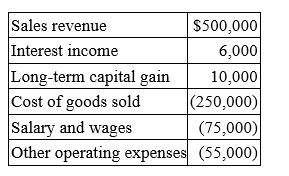

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

A) Ordinary income, $126,000; long-term capital gain is separately stated

B) Ordinary income, $120,000; interest income and long-term capital gain are separately stated

C) Ordinary income, $136,000; nothing is separately stated

D) Ordinary income, $195,000; interest income, long-term capital gain, and salary costs are separately stated

Correct Answer:

Verified

Q44: Which of the following statements regarding a

Q44: Martha Pim is a general partner in

Q48: Which of the following statements concerning partnerships

Q53: William is a member of an LLC.

Q54: In 2015, Mike Elfred received a $165,000

Q56: Alan is a general partner in ADK

Q57: Waters Corporation is an S corporation with

Q58: Kelly received a $60,000 salary during 2015.

Q59: Sue's 2015 net (take-home) pay was $23,205.

Q61: Perry is a partner in a calendar

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents