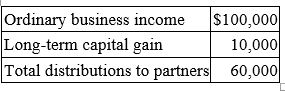

Mutt and Jeff are general partners in M&J Partnership and share profits and losses equally. Partnership operations for the current tax year were:  Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?

A) $25,000

B) $37,000

C) $13,000

D) $27,000

Correct Answer:

Verified

Q61: Perry is a partner in a calendar

Q62: At the beginning of year 1, Paulina

Q64: Bernard and Leon formed a partnership on

Q65: Max is a 10% limited partner in

Q67: Alex is a partner in a calendar

Q68: Which of the following statements regarding the

Q68: Funky Chicken is a calendar year general

Q71: Which of the following items would be

Q72: Cramer Corporation and Mr. Chips formed a

Q73: Which of the following statements about S

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents