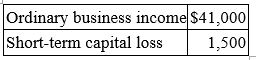

Alex is a partner in a calendar year partnership. His partnership Schedule K-1 for the current tax year showed the following:  Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?

Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?

A) $41,000

B) $32,500

C) $39,500

D) $34,000

Correct Answer:

Verified

Q62: At the beginning of year 1, Paulina

Q64: Bernard and Leon formed a partnership on

Q65: Max is a 10% limited partner in

Q66: Mutt and Jeff are general partners in

Q68: Which of the following statements regarding the

Q68: Funky Chicken is a calendar year general

Q71: Which of the following items would be

Q72: Cramer Corporation and Mr. Chips formed a

Q73: Which of the following statements about S

Q74: Jackie contributed $60,000 in cash to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents