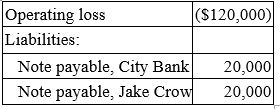

Orange, Inc. is a calendar year partnership with the following current year information:  On January 1, John James bought 50% general interest in Orange, Inc. for $30,000. How much of the operating loss may John deduct on his Form 1040?

On January 1, John James bought 50% general interest in Orange, Inc. for $30,000. How much of the operating loss may John deduct on his Form 1040?

A) $60,000

B) $30,000

C) $40,000

D) $50,000

Correct Answer:

Verified

Q63: Cramer Corporation and Mr. Chips formed a

Q64: Which of the following statements regarding a

Q67: Cramer Corporation and Mr. Chips formed a

Q68: Funky Chicken is a calendar year general

Q71: Which of the following items would be

Q71: Which of the following statements regarding limited

Q72: Cramer Corporation and Mr. Chips formed a

Q73: Which of the following statements about S

Q74: Jackie contributed $60,000 in cash to a

Q75: Gavin owns a 50% interest in London

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents