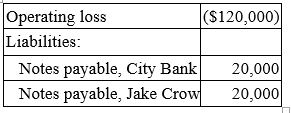

Cactus Company is a calendar year S corporation with the following current year information:  On January 1, John James bought 50% of Cactus Company stock for $30,000. How much of the operating loss may John deduct on his Form 1040?

On January 1, John James bought 50% of Cactus Company stock for $30,000. How much of the operating loss may John deduct on his Form 1040?

A) $60,000

B) $30,000

C) $40,000

D) $50,000

Correct Answer:

Verified

Q81: At the beginning of 2015, Quentin purchased

Q83: In 2015, William Wallace's sole proprietorship, Western

Q84: Refer to the facts in the preceding

Q85: On January 1, 2015, Laura Wang contributed

Q85: Adam and Barbara formed a partnership to

Q87: Loretta is the sole shareholder of Country

Q90: Bevo Partnership had the following financial activity

Q91: Loretta is the sole shareholder of Country

Q97: Which of the following statements regarding S

Q98: Which of the following statements regarding limited

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents