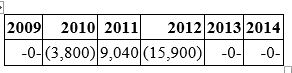

Proctor Inc. was incorporated in 2009 and adopted a calendar year. Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through  In 2015, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

In 2015, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

A) $25,000 Section 1231 gain

B) $19,700 ordinary gain and $5,300 Section 1231 gain

C) $15,900 ordinary gain and $9,100 Section 1231 gain

D) $25,000 ordinary gain

Correct Answer:

Verified

Q63: In its current tax year, PRS Corporation

Q82: Which of the following statements about Section

Q86: Which of the following assets is not

Q88: B&I Inc. sold a commercial office building

Q89: Delour Inc. was incorporated in 2009 and

Q90: This year, Adula Company sold equipment purchased

Q92: Irby Inc. was incorporated in 2009 and

Q96: Benlow Company, a calendar year taxpayer, sold

Q96: Mr. and Mrs. Marley operate a small

Q97: This year, Izard Company sold equipment purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents