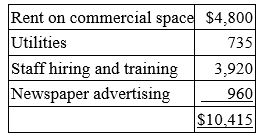

Vane Company, a calendar year taxpayer, incurred the following expenditures in the preoperating phase of a new health and fitness center.  Which of the following statements is true?

Which of the following statements is true?

A) If Vane already operates seven other health and fitness centers, it can deduct the $10,415 preoperating expenditures of the eighth center as expansion costs.

B) If Vane is a cash basis taxpayer, it can deduct $10,415 in the year of payment.

C) If the new center represents a new business for Vane, it must capitalize the $10,415 preoperating expenditures.

D) None of the above is true.

Correct Answer:

Verified

Q81: JebSim Inc. was organized on June 1

Q85: Ferelli Inc.is a calendar year taxpayer.On September

Q86: Mann Inc. paid $7,250 to a leasing

Q86: Which of the following statements about amortization

Q90: Mr. and Mrs. Schulte paid a $750,000

Q93: Mann Inc. negotiated a 36-month lease on

Q93: Powell Inc.was incorporated and began operations on

Q100: Which of the following capitalized cost is

Q100: Four years ago,Bettis Inc.paid a $5 million

Q100: Merkon Inc. must choose between purchasing a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents