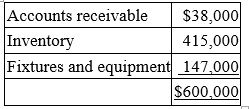

On April 2, Reid Inc., a calendar year taxpayer, paid a $750,000 lump-sum price to purchase a business. The appraised FMVs of the balance sheet assets were:  Which of the following statements is false?

Which of the following statements is false?

A) Reid must capitalize $150,000 of the cost as purchased goodwill.

B) Reid may amortize the $150,000 cost for both book and tax purposes.

C) Reid's amortization deduction for the current year is $7,500.

D) None of the above is false.

Correct Answer:

Verified

Q84: Szabi Inc., a calendar year taxpayer, purchased

Q85: Ferelli Inc.is a calendar year taxpayer.On September

Q86: In 2014, Rydin Company purchased one asset

Q86: Mann Inc. paid $7,250 to a leasing

Q90: Mr. and Mrs. Schulte paid a $750,000

Q93: Mann Inc. negotiated a 36-month lease on

Q94: Ingol,Inc.was organized on June 1 and began

Q96: Which of the following statements concerning business

Q98: Mr.and Mrs.Carleton founded Carleton Industries in 1993.This

Q100: Which of the following capitalized cost is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents