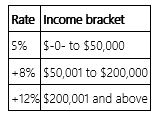

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is true?

Which of the following statements is true?

A) If Mrs. Hall's taxable income is $227,000, her average tax rate is 12%.

B) If Mr. Poe's taxable income is $41,200, his marginal tax rate is 8%.

C) If Ms. Kaye's taxable income is $63,800, her marginal tax rate is 8%.

D) None of the above is true.

Correct Answer:

Verified

Q62: Which of the following statements concerning a

Q63: Which of the following statements about a

Q71: Vervet County levies a real property tax

Q72: Which of the following statements concerning income

Q73: Jurisdiction M imposes an individual income tax

Q74: Congress originally enacted the federal estate and

Q77: Which of the following tax policies would

Q77: Which of the following statements concerning the

Q79: Which of the following statements about a

Q79: Congress plans to amend the federal income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents