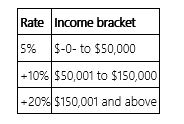

The country of Valhalla levies an income tax with the following rate structure.

A. Mrs. Greene's annual income is $125,000. Compute her tax, her average tax rate, and her marginal tax rate.

B. Mr. Chen's annual income is $220,000. Compute his tax, his average tax rate, and his marginal tax rate.

C. Does Valhalla have a proportionate, progressive, or regressive tax rate structure?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Which of the following statements about a

Q72: Which of the following statements concerning income

Q74: Congress originally enacted the federal estate and

Q77: Which of the following statements concerning the

Q77: Which of the following tax policies would

Q80: Congress plans to amend the federal income

Q82: Congress recently amended the tax law to

Q84: Mr.and Mrs.Boln earn $63,000 annual income and

Q85: Mr Ohno owns and operates a part-time

Q85: The City of Willford levies a flat

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents