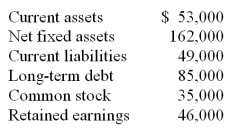

A firm has the following account balances for this year. Sales for the year are $600,000. Projected sales for next year are $642,000. The percentage of sales approach is used for pro forma purposes. All balance sheet accounts, except long-term debt and common stock, change according to that approach. The firm plans to decrease the long-term debt balance by $5,000 next year. Retained earnings is expected to increase by $3,500 next year. What is the projected external financing need?

A) $10,520

B) $13,120

C) $18,520

D) $20,720

E) $25,620

Correct Answer:

Verified

Q72: A firm has earnings per share of

Q81: A company has the following account balances.

Q81: Why is the expected rate of sales

Q84: What is the operating cash flow, given

Q88: A firm has sales of $750,000 and

Q89: A firm has current sales of $32,000.

Q93: A firm has total equity of $61,600

Q93: Explain the role the external financing need

Q97: The Erie Bay Liner Company has sales

Q99: What value does the Statement of Cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents