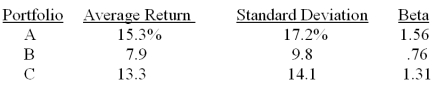

What is the Treynor ratio of a portfolio comprised of 25 percent portfolio A, 35 percent portfolio B, and 40 percent portfolio C?  The risk-free rate is 3.6 percent and the market risk premium is 8.2 percent.

The risk-free rate is 3.6 percent and the market risk premium is 8.2 percent.

A) .054

B) .062

C) .070

D) .081

E) .102

Correct Answer:

Verified

Q41: A portfolio has a Sharpe ratio of

Q61: A portfolio consists of the following two

Q62: What is the Treynor ratio of a

Q63: A fund has an alpha of 0.73

Q64: A portfolio has an actual return of

Q66: A portfolio consists of the following two

Q67: Your portfolio has a standard deviation of

Q68: What is Jensen's alpha of a portfolio

Q70: A portfolio has a standard deviation of

Q74: A diversified portfolio has a beta of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents