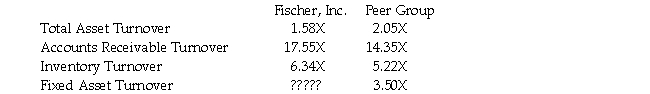

Asset efficiency ratios for Fischer,Inc.are given in the table below.Based on this information,Fischer,Inc.'s fixed asset turnover ratio is likely to be ________.

A) equal to 3.50

B) less than 3.50

C) greater than 3.50

D) negative

Correct Answer:

Verified

Q13: In an ideal world,which of the following

Q30: Total asset turnover is equal to accounts

Q44: Jones,Inc.has a current ratio equal to 1.40.Which

Q49: Smith Corporation has earned a return on

Q50: Company A has a higher days sales

Q52: The computation of return on equity,or ROE,does

Q53: Williams Inc.has a current ratio equal to

Q59: An analyst is evaluating two companies,A and

Q60: Company A and Company B have the

Q71: Benkart Corporation has sales of $5,000,000,net income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents