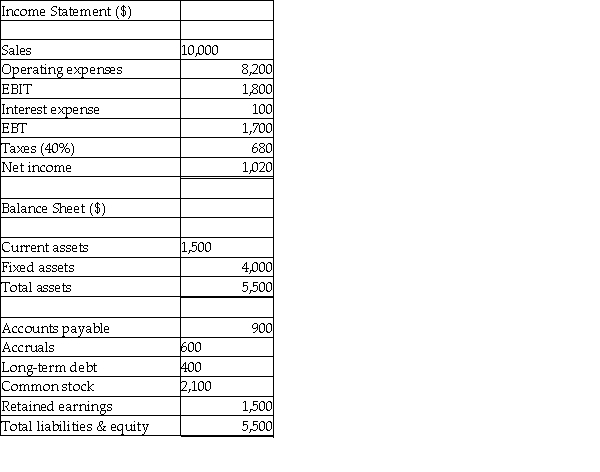

a.Using the financial statements for GMT Enterprises for 2010 (given below),calculate the return on equity,the debt ratio,and the times interest earned ratio. b.Suppose the industry average debt ratio is 50%.Give one reason why the debt ratio for GMT Enterprises may be considered favorable,and give one reason why the debt ratio for GMT Enterprises may be considered unfavorable. GMT Enterprises 2010 Financial Statements

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q120: WPM,Inc.has current assets of $8,000,000,current liabilities of

Q122: Rural Hydroponics has total equity of $560,000;

Q123: Blanton Corporation increased its financial leverage during

Q124: TransSystems Inc.has a total equity of $560,000;

Q125: All of the following will improve a

Q126: Bill's Bike Shop has a return on

Q128: Complete the following balance sheet using the

Q128: Beverly Corp.had total sales of $1,200,000 in

Q134: A company borrows $10,000 and puts the

Q136: Which of the following ratios would be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents