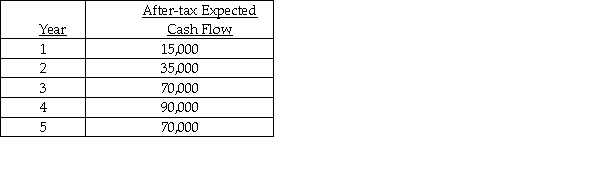

Dave Company,Inc.is considering purchasing a new grinding machine with a useful life of five years.The initial outlay for the machine is $165,000.The expected cash inflows are as follows:  Given that the firm has a 10% required rate of return,what is the NPV?

Given that the firm has a 10% required rate of return,what is the NPV?

Correct Answer:

Verified

Q28: As part of its expansion project,A.J.Industries Equipment

Q31: A company is expanding and has already

Q101: An asset with an original cost of

Q104: Agri-Industries purchased some agricultural land at the

Q105: Your company is considering the replacement of

Q110: A major corporation is considering a capital

Q111: LEE Corporation intends to purchase equipment for

Q115: P.D.Corporation is considering the purchase of a

Q120: Bellington,Inc.is considering the purchase of new,sophisticated machinery

Q135: A small,family-owned corporation would be more likely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents