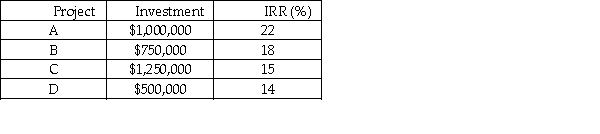

The Clydesdale Corporation has an optimal capital structure consisting of 70 percent debt and 30 percent equity.The marginal cost of capital is calculated to be 14.75 percent.Total earnings available to common stockholders for the coming year total $1,200,000.Investment opportunities are:  a.According to the residual dividend theory,what should the firm's total dividend payment be?

a.According to the residual dividend theory,what should the firm's total dividend payment be?

b.If the firm paid a total dividend of $675,000,and restricted equity financing to internally generated funds,which projects should be selected? Assume the marginal cost of capital is constant.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Analysis of dividend policy begins with the

Q81: Coppell Timber Company had total earnings last

Q83: Bass Frozen Foods,Inc.has found three acceptable investment

Q96: Salashar,Inc.'s balance sheet is as follows:

Q99: All of the following are likely to

Q104: The problem with the constant dividend payout

Q107: Which of the following dividend policies will

Q109: Flotation costs

A) include the fees paid to

Q110: Which of the following is (are)false?

A) The

Q119: AFB,Inc.had earnings per share of $4 per

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents