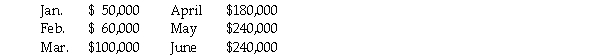

Rawhide Outfitters had projected its sales for the first six months of 2012 to be as follows:  Cost of goods sold is 60% of sales.Purchases are made and paid for two months prior to the sale.40% of sales are collected in the month of the sale,40% are collected in the month following the sale,and the remaining 20% in the second month following the sale.Total other cash expenses are $40,000/month.The company's cash balance as of March 1st,2012 is projected to be $40,000,and the company wants to maintain a minimum cash balance of $15,000.Excess cash will be used to retire short-term borrowing (if any exists) .Fielding has no short-term borrowing as of March 1st,2012.Assume that the interest rate on short-term borrowing is 1% per month.How much short term financing is needed by March 30,2012?

Cost of goods sold is 60% of sales.Purchases are made and paid for two months prior to the sale.40% of sales are collected in the month of the sale,40% are collected in the month following the sale,and the remaining 20% in the second month following the sale.Total other cash expenses are $40,000/month.The company's cash balance as of March 1st,2012 is projected to be $40,000,and the company wants to maintain a minimum cash balance of $15,000.Excess cash will be used to retire short-term borrowing (if any exists) .Fielding has no short-term borrowing as of March 1st,2012.Assume that the interest rate on short-term borrowing is 1% per month.How much short term financing is needed by March 30,2012?

A) $110,000

B) $15,000

C) $70,000

D) $85,000

Correct Answer:

Verified

Q62: What is the primary tool for short-term

Q121: Is it possible for the cash budget

Q130: Which of the following would NOT be

Q133: Fielding Wilderness Outfitters had projected its sales

Q134: The balance sheet of the Emery Company

Q135: LPD Logistics,Inc.'s projected sales for the first

Q136: LPD Logistics,Inc.'s projected sales for the first

Q138: LPD Logistics,Inc.'s projected sales for the first

Q140: The treasurer for Chic Man Clothing must

Q141: CBD Computer Inc.is attempting to estimate its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents